Date of exit : 30 Dec 2013

Title : Short To Realize Profit

I exited the trade at 2648 with a profit of 60 points this morning when the market open. The surge of the price seems not strong and it has been 10 days since I initiated the trade.

The Profit : RM 1500 (60 points x RM25 x 1contract = RM 1500)

The balance is now RM 26,200 (RM 24,700 + RM 1500 = RM 26,200)

(The details of my account is at My Future Trading Account Records 2013 )

Date of entry : 20 Dec 2013

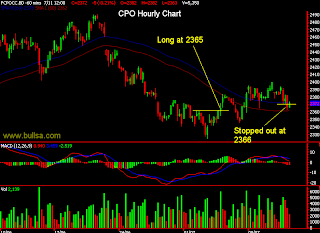

Title : Long CPO

I initiated long position for CPO March 2013 Future Contract at 2586 for 1 contract.